In Kind Benefits

What are in-kind benefits?

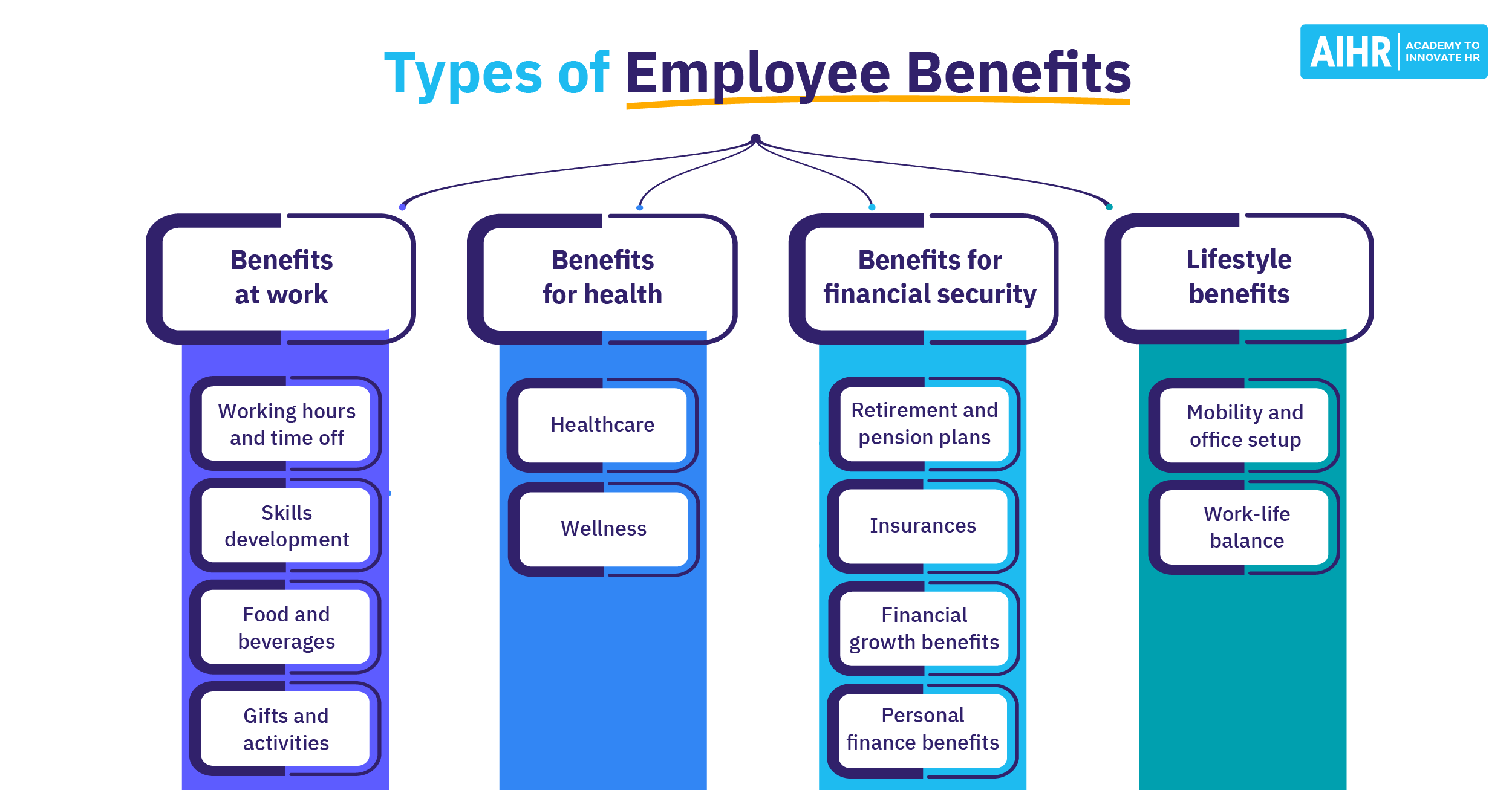

In-kind benefits, also known as benefits in kind (BIK), are non-monetary compensation provided to employees. They are part of an employee’s total compensation package but do not involve direct cash payments. Examples of in-kind benefits include services like health insurance, retirement plans, childcare assistance, and flexible working arrangements.

Mandatory vs. voluntary benefits

In the United States, some employee benefits are required by law at the federal level, such as Social Security and Medicare. Additionally, larger employers classified as Applicable Large Employers (ALEs) must offer health insurance under the Affordable Care Act (ACA).

On the other hand, most employee benefits are voluntary and provided at the employer’s discretion. These include options like paid time off, retirement contributions beyond Social Security, health insurance for smaller employers, and perks such as company cars or gym memberships.

HR often recommends several of these benefits to help attract and retain talent. However, in certain cases, some benefits can become mandatory through collective bargaining agreements with labor unions or specific regulations in certain industries.

15 in-kind benefits examples

Examples of these benefits include:

Healthcare benefits

These typically cover medical, dental, and vision expenses. An employer might offer a comprehensive health insurance plan that includes preventive care, surgeries, hospital stays, and even mental health services. For example, a company might cover 80% of medical costs, with employees paying the remainder.

Examples:

- Medical insurance (including coverage for dependents)

- Dental insurance

- Vision insurance

- Prescription drug coverage

Meals and refreshments

Many companies provide free or subsidized meals and refreshments. This can range from fully catered cafeterias to snack rooms stocked with healthy options. For instance, a tech startup might offer a free gourmet lunch daily or have a kitchen filled with snacks and drinks for employees.

Examples:

- Free or subsidized meals in company cafeterias

- Snacks and beverages provided in the workplace

Transportation benefits

This could include subsidies for public transportation, parking allowances, or even shuttle services from key locations to the office. A large corporation might offer metro card reimbursements or have a fleet of buses that pick up employees from various locations.

Examples:

- Company-provided vehicles

- Commuting allowances (e.g., public transportation subsidies, parking allowances)

- Company shuttle services

Retirement benefits

Common retirement benefits include contributions to pension plans or 401(k) accounts. An employer might match employee contributions to a certain percentage, helping build their retirement savings. For example, a company might offer a 50% match for the first 6% of salary an employee contributes to their 401(k).

Examples:

- 401(k) matching contributions

- Pension plans

Accommodation

Some employers provide housing or housing allowances, especially in industries like mining or oil and gas, where employees need to be close to remote work sites. A company providing on-site living quarters for employees working in remote areas would be an example.

Example:

- Company-provided housing

- Housing allowances

Childcare assistance

This can include on-site childcare facilities or subsidies to offset the cost of external childcare services. A large corporation might operate a daycare center at the workplace or partner with local providers for discounted rates.

Examples:

- On-site childcare facilities

- Subsidized childcare costs

Design compensation strategies that include in-kind benefits

In-kind benefits like health insurance, childcare assistance, or transportation subsidies can boost employee satisfaction and help your organization stay competitive—without increasing base pay.

In AIHR’s Compensation & Benefits Certificate Program, you’ll learn how to structure total rewards packages that go beyond salary. Discover how to evaluate, administer, and communicate in-kind benefits effectively while staying compliant with tax and labor laws.

Are in-kind benefits taxable?

In-kind benefits can be taxable, but the specifics depend on the type and value of the benefits and the tax laws of the particular country or region.

The taxability of these benefits is governed by the Internal Revenue Service (IRS) regulations, and it’s important for both employers and employees to be aware of these rules to ensure compliance and accurate reporting.

Let’s explore the difference between taxable and non-taxable in-kind benefits:

1. Taxable in-kind benefits

Taxable in-kind benefits are considered part of an employee’s taxable income. These benefits provide personal advantages to employees and thus are subject to income tax and other employment taxes. The valuation of these benefits is typically based on their fair market value.

Common examples of taxable in-kind benefits include:

- Personal use of a company car

- Housing provided by the employer

- Gym memberships or tickets to events

2. Non-taxable in-kind benefits

Non-taxable in-kind benefits are excluded from an employee’s taxable income. These benefits are often considered necessary for the performance of a job or are so minimal in value that taxing them is unreasonable or administratively impractical.

Examples of non-taxable in-kind benefits include:

- Health insurance

- Educational assistance

- Employee discounts (on goods or services)

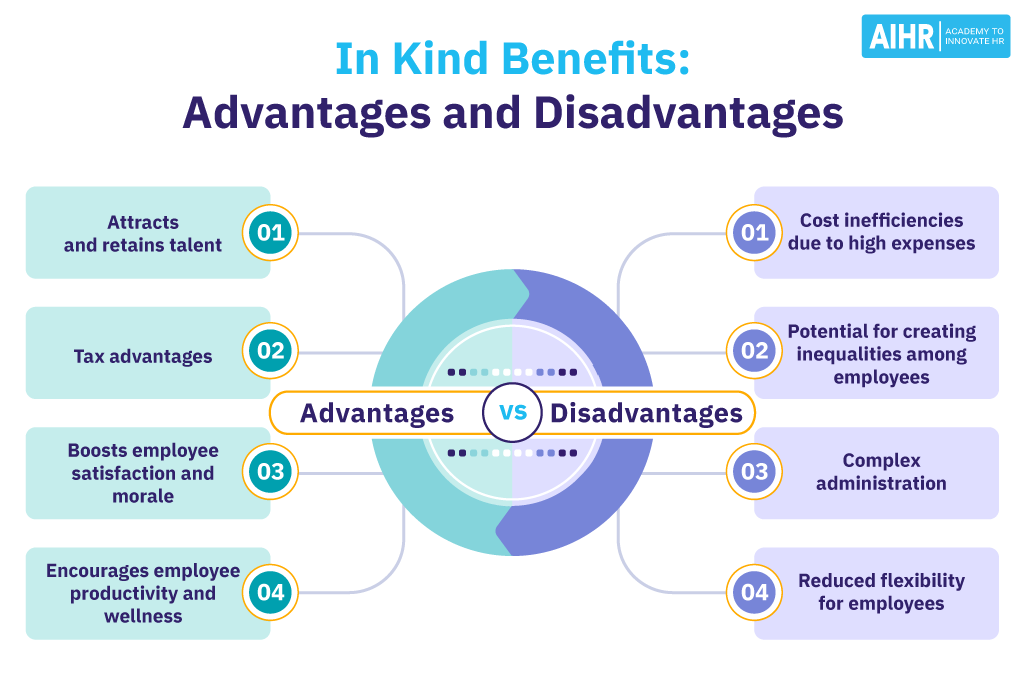

Advantages and disadvantages of in-kind benefits

Here are some of the advantages and disadvantages of offering these benefits:

Cost inefficiencies: Providing in-kind benefits can sometimes be more costly for employers, especially if the benefits are specialized or require ongoing maintenance and support.

Cost inefficiencies: Providing in kind benefits can sometimes be more costly for employers, especially if the benefits are specialized or require ongoing maintenance and support.

Boosts employee satisfaction and morale: In-kind benefits can significantly elevate morale and job satisfaction. They often address specific employee needs, making employees feel valued and cared for.

Potential for creating inequality: If not managed carefully, in-kind benefits can create perceived or actual disparities among employees, especially if some benefits are only available to certain groups or levels within the organization.

Complex administration: Managing in-kind benefits often requires more administrative effort than cash benefits. This includes tracking usage, maintaining inventory, and ensuring equitable employee distribution.

Complex administration: Managing in kind benefits often requires more administrative effort than cash benefits. This includes tracking usage, maintaining inventory, and ensuring equitable employee distribution.

Encourages employee productivity and wellness: Benefits like gym memberships, wellness programs, or ergonomic office furniture can lead to healthier, more energetic employees, which in turn can boost productivity.

Reduced flexibility for employees: Some employees might prefer a higher salary over in-kind benefits, especially if the benefits provided are not aligned with their personal needs or lifestyle.

What should HR consider when including in-kind benefits in compensation?

Before including these benefits in employee’s compensation packages, HR should take several important factors into account:

- Legal and tax implications: It’s essential to understand the legal and tax implications of offering certain in-kind benefits. Some benefits may be taxable for the employee or might have compliance requirements under labor laws.

- Ease of administration: The logistical aspect of offering and managing these benefits should be manageable and not overly burdensome for the HR department.

- Employees needs and preferences: Tailoring in-kind benefits to the needs and preferences of the current workforce is crucial. This may involve conducting surveys or focus groups to determine which benefits are most valued by employees.

- Cost and budget implications: It’s important to evaluate the financial impact of offering these benefits, including initial setup costs, ongoing expenses, and any potential cost savings compared to other forms of compensation.

- Competitiveness in the market: The benefits package should be competitive to attract and retain talent. Researching what similar companies in the industry offer can provide valuable insights.

Resources for HR professionals

Government agencies:

- Internal Revenue Service (IRS): Serves as a comprehensive resource for all tax-related information, including forms and publications.

- Department of Labor (DOL): Provides a wealth of information on US labor laws, including the Fair Labor Standards Act (FLSA) and the Employee Retirement Income Security Act (ERISA).

- Affordable Care Act (ACA) Resources: Both the IRS and DOL websites offer dedicated sections with information on employer responsibilities, including requirements for offering health insurance and related reporting obligations.

FAQ

An in-kind benefit program is a system where employers offer non-cash compensation like health insurance or company cars to employees in addition to their salary

In-kind benefits are non-monetary compensations provided to employees, like goods and services such as free meals, company cars, health insurance, gym memberships, childcare assistance, or educational subsidies. They are perks or fringe benefits that enhance an employee’s salary package, offering practical value and often contributing to job satisfaction and work-life balance.

The most common in-kind benefits include health insurance, retirement plans like 401(k) or pensions, company-provided vehicles or transportation allowances, educational assistance or tuition reimbursement, and flexible working arrangements such as remote work options or flexible hours. These benefits are designed to support the overall wellbeing and satisfaction of employees.

In-kind assistance generally refers to non-monetary support or aid, often aimed at meeting specific needs like meals or transportation, and can be provided by employers or other entities.

In-kind income is any form of compensation or benefit an employee receives that is not money or cash, such as goods or services from an employer or government assistance like food or housing subsidies.